The Tax Cuts and Jobs Act of 2017 more than doubled the lifetime estate tax exemption, increasing from $5.6 million for individuals and $11.8 million for married couples to an inflation-adjusted $13.61 million for individuals and $27.22 million for married couples in 2024. Unless Congress acts, this legislation will expire on Jan. 1, 2026, and the exemptions will revert or “sunset” to the 2017 amounts adjusted for inflation. This will be approximately $7 million for individuals and $14 million for married couples.

With the boom in the auto industry over the last few years, more dealers will be facing a taxable estate after the exemption sunsets. However, there is an opportunity to utilize the higher exemption amounts through gifting before 2026. Appreciating assets subject to valuation discounts (such as a minority interest in an automobile dealership) are ideal for gifting because future appreciation escapes estate tax and valuation discounts allow the assets to be valued at a lower amount for gift tax purposes. It is worth noting that these types of gifts are subject to more IRS scrutiny, so using a business appraiser who frequently values auto dealerships to provide a business valuation report is highly recommended.

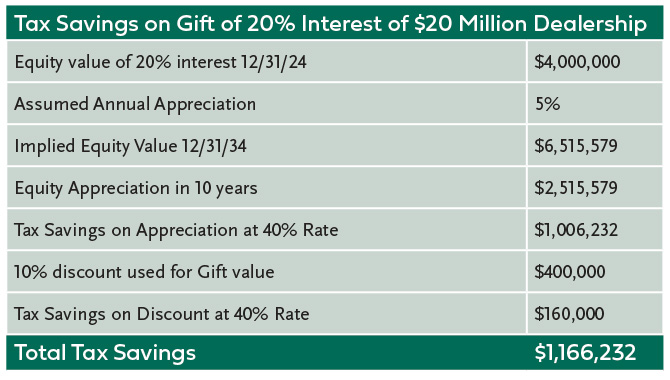

Let’s look at an example of the estate tax savings that could result from gifting a 20% interest in a dealership worth $20 million today. For simplicity purposes, let’s assume a 10% discount for lack of control and marketability and an annual appreciation of 5%.

When considering which assets to gift, if any, remember that you will lose control over the assets and the income they generate once you transfer them to someone else. Assess your cash flow needs before making any transfers, but don’t wait too long to act. Experts predict there will be an uptick in gift tax return filings leading up to the sunset date. Start working now with your estate planning advisors to develop the right plan for you and your family.

Tasha Sinclair, CPA/ABV is a principal of Tetrick & Bartlett PLLC and has been providing accounting, tax, valuation and consulting services to automobile dealers since 2002. Tetrick & Bartlett PLLC currently serves over 50 dealers in West Virginia, Virginia, Ohio and Pennsylvania and is a member of the AutoCPA Group, a nationwide organization of CPA firms specializing in services to automobile dealers. Tasha can be reached at tsinclair@tb.cpa or (304) 624-5564.