In the past couple of years, the auto retail business has shown remarkable adaptability, changing to meet new demands during the global pandemic. Not only have dealers addressed an array of challenges — inventory depletion, supply chain disruptions and a skilled labor shortage — while still having some of the most profitable years, but they’ve also responded to evolving consumer buying preferences. Today, 40% of Americans say they’re prepared to configure and purchase a car online, only visiting the dealership for a test drive.1

From sophisticated, tech-based marketing to digital documentation, dealers embrace digital transformation as they strive for efficiency to streamline the buying process. Equally important, savvy auto dealers are welcoming innovations for making and receiving payments.

Faster, Easier and More Secure Payments

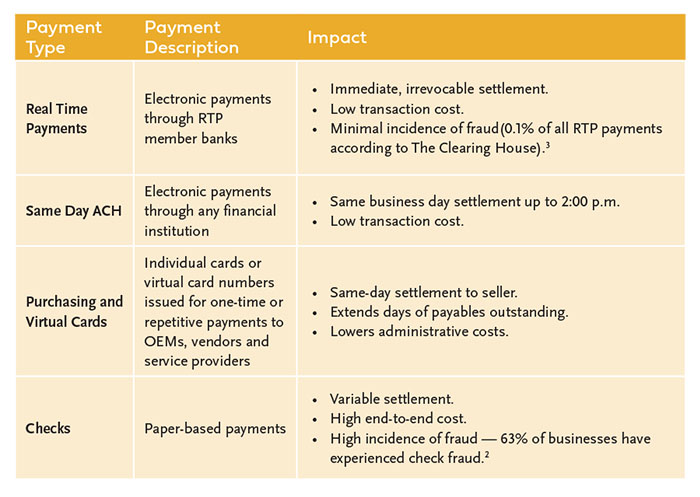

Payment solutions have progressed to become faster, more secure and easier to execute. New options — from Zelle®, PayPal and Real Time Payments (RTP), to Same Day ACH — offer consumers and businesses faster ways to exchange funds.

Traditional payment types are plagued with a high risk of fraud. By a wide margin, checks represent the number one fraud risk among payment choices; 63% of respondents in a 2023 survey experienced attempted or actual check fraud at their organization.2

Newer payment methods are constantly upgraded to offer stronger security measures. Consumer demands for faster settlement and funds availability are spurring the shift to digital payments. The latest payment options reflect society’s broad desire for immediacy and younger purchasers’ expectations for simple, digital execution.

Find the Best Way To Pay

To realize the advantages of new payment types, auto retailers often start with payables, exploring options to manage private-party, used car purchases, efficiently process customer refunds, handle marketing and advertising expenses, and pay contractors, suppliers and vendors. Processing a paper check creates additional steps for both parties and exposes them to a higher risk of fraud or loss. By moving away from checks, funds can be managed more efficiently, and the transaction can be completed more quickly.

Over the coming years, dealers will need to continue to embrace consumer’s universal push for agility and immediacy. The pressure for the same instant fulfillment that customers experience at other kinds of businesses will extend to every aspect of the way auto retailers market, sell and close purchases.

As buying becomes more digital, customers — accustomed to the Zelle and PayPal experience — will start to expect the same speedy movement of funds for an auto purchase that they see in other transactions in their daily lives.

Yet buyers’ preferences are only one factor to consider in your approach to payments — speed of execution, fees and the risk of payment reversal are part of the equation as well. Payment options need to align with delivery and fulfillment and integrate with your documentation process.

For now, merchant services remain the preferred means that auto retailers use to secure payment for deposits, in-person sales, and parts and services. A familiar choice for customers, it can be implemented in both face-to-face and e-commerce settings.

Key Business Payment Options

As you consider the best type of payment for each purpose, keep in mind that a bank like Truist can accept a single file with multiple payment types and then separate and direct each payment where it needs to go. That consolidated payments approach could simplify the time your finance and technology teams spend staging payments.

Building a Payments Strategy

The range and sophistication of payment options continue to evolve. Payments planning as you work toward creating a payments policy can help ensure your choices align with your business goals and provide the most efficient and cost-effective option for each type of payment you make.

Developing a sound payments process starts with a careful assessment of all your incoming and outgoing payments, along with the business requirements behind each one. Examine each type of payment you make in terms of security, speed, cost and convenience involved in moving those funds.

Questions you will want to consider include:

- When should you remit payment based on terms and discounts?

- Do you have a hierarchy of preferred payment options based on transaction cost and ability to mitigate fraud? For example, your preferred payment method may be virtual cards, followed by ACH and RTP.

- Do you have segregation of duties where one person enters the payment and a second person approves the payment?

A payments strategy can guide you in improving the use of your working capital as you hold onto funds longer before remitting payment, send payments the most cost-effective way, mitigate fraud risks and ensure proper payment authorization. As you begin to design your own payments strategy, refer to the business payments options outlined above.

A Corporate Payments Strategy — A Smart Choice

Apply the same energy toward payments you use to reach customers through marketing and sales. Your Truist Dealer Services relationship manager can help you determine the best payment options for your business.

- Digital Auto Report 2023 Volume 1 — Understanding Customer Preferences and Implications, PWC, 2023.

- AFP 2023 Payments Fraud and Control Survey, Association for Financial Professionals, 2023.

- John Adams, Real-time payments leave little time to spot fraud, American Banker, October 23, 2023.

Truist Bank, Member FDIC and Equal Housing Lender. ©2024 Truist Financial Corporation.