By West Virginia Automobile Dealer Association

As the first quarter of 2021 ends, the end of the pandemic is beginning to look like it might be closer than anyone thought as recently as January. A new president is in the White House, three vaccines have been approved for use, and medical professionals throughout the nation are getting those vaccines into people at an accelerating rate. The country is moving closer to herd immunity every day. As a result, analysts and industry executives expect strong demand as the economy stabilizes. Early forecasts predict vehicle sales between 15.6 million and 16 million.

One of the most surprising aspects of the last year is that profits have been high, strong and consistent. When the country stopped in March, including the automotive industry, no one saw that coming.

What is the best way to plan, prepare and pivot? The answer will depend on your specific circumstances, so the first step is assessing your current situation. To start, answer a few basic questions:

- How has your year been for your dealership?

- Is it better, worse or the way you thought it would be?

- What does the data tell you?

- What should you do next?

According to attendees at a recent NADA webinar about planning, preparing and pivoting for 2021, 78% of the dealerships were having a better year, 13% were having the kind of year they expected, and 9% were struggling more than expected.

As you look toward 2021, ask yourself the following questions:

- Where are your best opportunities?

- What changes in customer buying behaviors have taken place?

- How can you adapt to meet customer’s evolving expectations more effectively?

Members of the industry obviously want the numbers to continue to go up. For that to happen, though, now is the time to work smarter and put the necessary processes into place.

In the spring of 2020, before the pandemic, dealers had plenty of inventory on their lots and a great deal of sales activity. It was hard to find a place to park on some dealership lots because so many cars were already parked there, ready to purchase. That ended during the late spring and summer when factories had been shut down. According to IHS Markit, factory output decreased by 2.538 million units. The percent growth, year over year, dropped by 16.4% from the forecasts. Suddenly, there weren’t as many new vehicles on the lot. Inventories were lowest in June, especially on the truck side of the market.

The vehicle forecast for 2021 is promising. Although the numbers are down, they aren’t terrible, either. IHS Markit has stated that percent growth year over year is expected to be up by 8.8%, although the number of vehicles being built will still have dropped by 1.043 million units from the pre-pandemic estimate. The year 2021 will be a critical time for continued recovery. However, overall, the recovery seems to be going faster than anyone anticipated, and dealers have shown you can still make money by selling cars. Although it may take four years to bounce back to the same sales levels as those in 2019, optimism is reasonable if you focus on profit instead of volume.

How big was the production drop for manufacturers? U.S. dealerships sell substantially more trucks than cars, so production numbers match that sales expectation. According to Motor Intelligence:

- In January and February, truck production fell 6%, and car production fell 26%.

- By June, car sales were about the same (with a drop of approximately 26%), but truck sales had fallen 34%.

- In October, the production drop for cars was 22%; it was 26% for trucks.

Dealers prosper when manufacturers prosper; it has always been a synergistic relationship. But going into 2021, you can’t sell a commodity you can’t get. Since dealers have an inventory gap for new vehicles, that reality means this is a great time to pivot toward preowned ones and focus on vehicle acquisition.

The inventory gap will continue going into 2021. No one knows yet whether the gap will continue or disappear. If matters continue to improve, the production gap may be gone by the end of the year. But you will want to come up with new processes to minimize the inventory gaps we know for sure we will have and maximize selling inventory as effectively as possible.

Dealers prosper when manufacturers prosper; it has always been a synergistic relationship. But going into 2021, you can’t sell a commodity you can’t get. Since dealers have an inventory gap for new vehicles, that reality means this is a great time to pivot toward preowned ones and focus on vehicle acquisition. This particular pivot is not surprising. According to Tanja Linken of IH Markt and Pete Margaros of automotive Mastermind during a recent NADA webinar, the used market typically increases and the new market decreases during an industry crisis.

Increased demand for used vehicles has already driven up auction prices. How can you combat that? Many vehicles currently on the road were purchased during the record sales years that preceded the pandemic. The vehicles sold by your dealership form a portfolio you can now manage as buyers tilt toward used cars instead of new ones. Doing so will be cheaper than using auctions.

According to IHS Markit, dealers are currently selling approximately three used cars for every new one. To close the deal, though, you will need to finance the sale 90% of the time. Be competitive. OEMs responded to the pandemic by offering incredible financing offers in the new car market, and most financing companies did leasing extensions. For example, some OEM programs offered 0% for 84 months, effectively taking many potential customers out of the market for seven years. However, the leases that were extended are coming due now.

Approximately 72% of all deals made have longer terms, so each sale matters because it will be a while before you will have another opportunity. Afterward, your customers are off the market and on a relationship journey with your dealership. What you do during that time may determine whether they buy their next vehicle from you, too, but they are also giving you the chance to make money before the next sale.

The ideal sales strategy focuses on solving a customer’s problem, not persuading them to buy something they don’t need or want. Having information about a customer gives you that chance to solve instead of sell.

Portfolio management means paying attention to matters such as:

- The date a customer’s factory warranty expires

- When their loan or lease expires

- Whether you can save them money on gas

- Their equity position

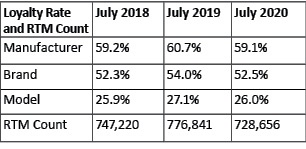

Customer loyalty can be defined in three ways: loyalty to the manufacturer, the brand and the model. Loyalty drops when customers look for a new car, so much so that many sales can be classified as one and done. What are the supporting numbers? IHS offers the following numbers in July of 2018, 2019 and 2020:

The loyalty drop works to your advantage with new customers, but do what you can to minimize losing existing customers. Having a data-driven strategy in place is an excellent way to keep customers loyal by knowing what matters to them and speaking up at the right time with the right offer. To reach customers at the right time, monitor channels such as social media, your website, and customers who walk in the door; that includes customers in the service department. Reach out to customers with a call to action.

As you focus on the service department, you may want to rethink compensation. Employees on the service side should be compensated as generously as employees on the sales side when contributing to the dealership’s success. Reward their help if they are involved in a sale.

When reaching out to a customer, how do you know what you should offer them? People generally have two goals when they are making a big purchase. They want financial help to make the purchase possible, and they want to mitigate the risks inherent in spending a large sum of money. Customers are also interested in saving money. Look for ways customers can find money to spend at your dealership, and set up deals that make sense for them to agree to.

Of course, it isn’t enough to sell to existing customers. You also have to look for new customers. Customers have changed their buying habits, and the pandemic has accelerated the change. Some customers still only buy in person because they understand that process. But customers also like buying online, and some customers use a combination of the two (such as researching online and communicating by email). According to IHS Markit, U.S. customers buying at the first major pandemic peak could be classified as follows:

- Dealership purchases: 38%

- Combined purchases (dealership and online): 27%

- Online purchases: 34%

How you handle online leads will make a difference in whether you make sales. More people are shopping online and seeing posts than are walking through the door of the dealership. Assuming they don’t make the entire purchase on your website, they may eventually step into the building ready to buy. That readiness is useful information for you to have. Your goal should be to make the process seamless and frictionless. You also have an opportunity to streamline.

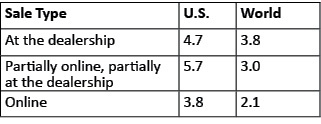

One way to analyze your existing processes is by looking at how many employees a customer interacts with during a purchase. IHS Markit researched this question at dealerships in the U.S. and other countries:

The table shows a couple of missed opportunities.

- In the U.S., 5.7 employees interact with a customer when the sale is conducted online and in the dealership. That’s more than at the dealership or online.

- Outside the U.S., customers deal with fewer employees, period.

Let’s explore the missed opportunities:

- The handoff between being online and going to the dealership is not seamless. When online customers walk into dealerships, they start the process at the beginning again instead of resuming where they left off. That shouldn’t happen.

- U.S. dealerships are less efficient than dealerships outside the U.S. Online customers at U.S. dealerships are generally directed to a receptionist. Outside the U.S., dealerships send online customers directly to a product expert. The expert focuses on solving problems for the customer.

What is going to change after the pandemic ends? Less than you think. It’s a no-brainer to improve your website service, of course, but time-tested sales strategies will also continue to work. Manage inventory intelligently, strategize every sales channel and let data help you focus on customer service:

- Good relationships continue to be the real foundation of any business. People like to buy from friends they trust. That hasn’t changed, and it isn’t going to change.

People are social. They will still want to come to the dealership. They will appreciate having the option of picking up their vehicle from the dealership or having it delivered to their home. - Look at your sales processes, and adjust them to make them work better. The first contact with a customer should be with a member of the sales staff, or someone who specializes in, or is a product expert about, whatever the customer is likely to buy. Have this employee gently guide the customer through the process by focusing on whatever problem the customer has. Be solution-centric, not sales-centric, and emphasize professional expertise, not selling. You can upsell later.

- You will do your best on the internet if you put high-quality people online to interact with potential customers.

- Study Amazon’s example when it comes to your website. Amazon provides a tailored, quality experience. When Amazon makes suggestions, the suggestions increase its revenue by 40%.

- Online and hybrid options are convenient. Customers like them, so they are here to stay. Anything that makes buying effortless and uncomplicated is good.