By Jared Wyrick

As we conclude the 2021 Regular Legislative Session, it is safe to say that this has been a session unlike any other. Due to the ongoing COVID pandemic, the Capitol Police implemented several new safety protocols that made it more difficult to get inside the Capitol and conduct face-to-face meetings with the elected officials.

In an effort to meet with Senators, Delegates and the Governor’s Office, WVADA hosted weekly receptions at the Association office. These receptions were a huge hit and we had an overwhelming turnout each week. A special thank you to Bill Cole Auto Mall, Miller Auto Group, Moses Auto Group, Stephens Auto Center, Thornhill Auto Group, and Yes Chevrolet/Yes Ford for sponsoring our receptions.

First and foremost, there were NO bills introduced in this session regarding direct sales (Tesla, Rivian, etc.), nor were there any other bills introduced this year that affected YOUR current franchise law. WVADA stepped up in a big way this past election in contributing to dealer-friendly candidates. Elections matter, and elected representatives are the ones that ultimately vote on laws that affect how you operate your business. WVADA is committed to representing our dealer members, and we ask that you continue/develop relationships with elected members from your area.

Being involved and contributing to WVCAR and NADA PAC are two important ways you can help support our industry’s advocacy. I appreciate everyone that has participated and look forward to more involvement as we move forward.

Below are summaries of bills that WVADA worked on this session:

S.B. 5 Relating to claims arising out of the WV Consumer Credit Protection Act (completed legislative action – signed by the Governor)

This bill was WVADA’s version of “loser pay” and served as a major priority for us this session. This bill passed the Senate, 23 -9 (2 absent), and passed the House of Delegates, 77-22 (1 absent). The Governor signed the bill on March 29, and this bill will become effective for all suits filed on or after June 16, 2021.

This bill does the following:

- Clarified the basis on which the plaintiff’s attorney can recover attorney fees and included a requirement that the Court look at the amount involved and the plaintiff’s recovery.

- Increased from 20 days to 45 days the dealer’s ability to respond to a settlement demand letter from a consumer prior to the consumer being able to file suit.

- In addition to the requirement of the cure offer, we created a brand-new section on Offers of Settlement, which will allow a dealer to make up to three offers of settlement, even after a suit is filed.

- The cure offer language remains the same and cuts off attorney fees from the date of the cure offer if the consumer’s recovery does not exceed the cure offer

at trial. - The offers of settlement are important because if a fair offer of settlement is made, and the consumer recovers less than 75% of that offer, the plaintiff’s attorney fees and costs are cut off from the date of the offer of settlement. Importantly, if this occurs, the dealer also has the chance to recover its attorney fees and costs from the date of the offer of settlement under certain circumstances.

- The new offer of settlement provision also gives prevailing parties (both consumers and dealers) the right to seek fees and costs for frivolous claims that are asserte

Delegate Johnnie Wamsley, (R-Mason, 14) & Delegate Zack Maynard (R-Lincoln, 22) take a test drive in a 2019 Shelby F-150 during the weekly WVADA reception.

S.B. 277 – Creating COVID-19 Jobs Protection Act (completed legislative action – signed by Governor)

This bill will prohibit civil actions for any loss, damages, personal injury or death arising from COVID-19 against any individual or entity.

However, the bill does not preclude an employee from filing a claim for workers’ compensation benefits, nor does it preclude a product liability claim wherein it is shown there was actual malice, actual knowledge of a defect or conscious, reckless, and outrageous indifference to a substantial and unnecessary risk that the product would cause serious injury to others. It also expressly does not affect rights or obligations under a contract.

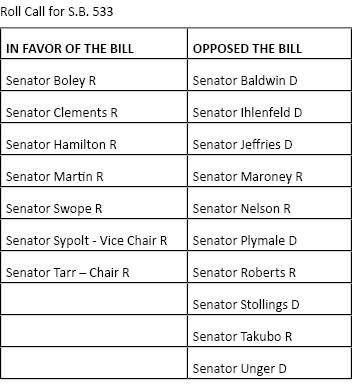

S.B. 533 – Relating to Allowable Limits of Business and Occupation Taxes Imposed on Sale of Automobiles (died in Senate Finance Committee)

The Senate Finance Committee considered this bill. There are 17 members on the Senate Finance Committee, 11 Republicans and six Democrats. All Democrats voted against the bill, and four Republicans crossed over and joined the Dems.

While we lost the bill in committee this year, I truly believe that we are making progress on this issue. A bill was drafted, introduced by the Senate Finance Chairman, and the bill made an agenda where a positive discussion took place. This issue is now being turned into a study resolution that will take place throughout the upcoming months. I have spoken to several dealers about this issue, and we will continue to pursue relief for those dealers affected by B&O taxes. Once the session is finished, I plan to create a B&O task force made up of dealers and mayors to work together on this issue.

A special thank you to Joey Holland, Joe Holland Chevrolet and Imports, for taking the time to testify before the Senate Caucus and the Senate Finance Committee. Joey did an exceptional job, and WVADA greatly appreciates his time and willingness to address this issue on behalf of all WV dealers who face this unfair, regressive tax.

A special thank you to Joey Holland, Joe Holland Chevrolet and Imports, for taking the time to testify before the Senate Caucus and the Senate Finance Committee.

S.B. 626 – Updating Regulation for Purchase of Automobile Catalytic Converters (Completed Legislative action – pending Governor’s signature)

WVADA worked this bill in conjunction with the WV Sheriffs Association. Catalytic converter thefts are becoming more and more prevalent throughout WV. This bill requires a scrap metal dealer to obtain a valid driver’s license or ID card, a thumbprint, and written documentation reflecting that the seller is authorized to possess and sell a catalytic converter.

This bill adds a new section that makes it a misdemeanor for any person possessing a catalytic converter, which had previously been installed on a motor vehicle, without proof of ownership. If convicted that person would be guilty of a misdemeanor, confined in jail for up to 12 months, and would be fined up to $1,000 for each catalytic convertor in their possession. This bill also makes it illegal for individuals to post and sell catalytic converters on an internet-based platform.

Also, a scrap dealer must pay for a stand-alone converter(s) via check and are not allowed to pay cash. A scrap dealer must hold the catalytic converter for 14 days after it is acquired. Provided that the 14-day retention requirement may be reduced to five days if, within the five days, the scrap dealer provides all documentation to the local detachment of the State Police and the chief of police of the municipality or the sheriff of the county in which he or she is transacting business. Also, a scrap dealer CANNOT purchase or take possession of a catalytic converter if the identifying information on it has been manually altered.

A special thank you to Richard Stephens and Bill Cole for taking the time to testify before the Senate Judiciary Committee. Richard and Bill did an exceptional job and WVADA greatly appreciates their time and willingness to address this issue on behalf of all WV dealers who have been affected by this ongoing theft.

Delegate Matt Rohrback (R-Cabell, 17) in the passenger seat and Delegate Erikka Storch (R-Ohio, 3) back seat, enjoy a test drive in the 2021 Ford Mustang Mach-E.

H.B. 2001 – Creating the WV Jumpstart Program (completed legislative action – signed by Governor)

WV is the first state in the nation to implement this innovative program that will truly help build up our blue-collar workforce. The Jumpstart Program will allow individuals who wish to pursue a vocation or trade to make up to $25,000 in annual tax-free contributions to a savings and investment account that can then be used to help cover the business startup costs, equipment, tools, certifications and licenses needed for their occupation.

This is a great program for our industry, considering the shortage of auto mechanics in WV and nationwide. I believe that WVADA has a great opportunity to support this program through potential scholarships to incentivize and direct more individuals toward the automotive industry.

H.B. 3175 – Relating to Removing Certain Felonies that can Prohibit Vehicle Salespersons from Receiving a License (Completed Legislative Action – pending Governor signature)

The WVADA Board overwhelmingly voted to eliminate this requirement. As many of you know, vehicle salesperson licensure was established in 2006. The intent of licensing individuals to sell automobiles has not been effective. Currently, if an individual has a past felony, they are automatically denied a license. However, according to the DMV, over 95% of individuals denied licensure receive a license via the appeal process.

In addition, the test has become outdated and applicants must make an appointment, some of which are unable to get an appointment for several months. The DMV was supportive of eliminating this requirement and they do not believe that it is their place to regulate employees of dealerships.

Reduction/Elimination of Personal Income Tax

“We may never have an opportunity like this ever again,” Governor Justice said. From 1950 to 2016, the total population of the United States doubled. In that same time frame, 49 out of 50 states saw their population increase, except West Virginia. Between 2010 and 2020, WV’s population decreased by 3.8%, the steepest rate of population decline in the country.

“We have all the building blocks in our state and an economy that’s truly on the launchpad. The last piece of this puzzle is the elimination of our personal income tax. That’s why I am proposing a plan to make this dream a reality starting with a 60% reduction in state income tax for year one,” said Justice.

The majority of this session was dedicated to discussions revolving around the Governor’s reduction/elimination of Personal Income Tax (PIT). While the Governor, Senate and House of Delegates support the eventual elimination of PIT, they all three have very different approaches as to the appropriate avenue to backfill the $2 billion deficit this elimination would incur. As of now, there does not seem to be an agreed-to approach, and more than likely, this issue will take the form of a special session in the upcoming months.

Governor’s Version

S.B. 600 – Relating to Personal Income Tax Reduction

This bill will reduce State income tax brackets as follows:

Total Tax Reduction: $1,087,650,000

- Tax rates for all filers reduced by 60%

- Will reduce PIT by 60% ($1,035,650,000) on income earned from:

◦ Wages and salaries

◦ Pensions, annuities, IRAs, Social Security and Unemployment - The reduction excludes income earned from

the following:

◦ Schedule C Business Profits

◦ Schedule E Rents, Royalties, and Pass through

entity profits

◦ Schedule D Capital Gains

◦ Schedule F Farm income

◦ Supplemental Gains and Losses

◦ Taxable Interest Income

◦ Dividend Income

◦ Miscellaneous Income

This bill will increase taxes as follows:

- Total Tax Increase: 902,600,000

Increase consumer sales tax from 6%-7.9%

(excludes automobiles) - Will begin taxing professional services

- Create a luxury items tax for certain specified items (excludes automobiles)

- Change natural gas severance tax from 5% to a tiered rate system

- Increases wet gas severance tax from 5% to 6.5%

- Increases the coal thin seam severance tax rates from 1% or 2% to a new tiered structure

- Increases the coal severance tax from 3% on steam and 5% on met and other coal to a tiered rate structure

- Changes oil severance tax from 5% to a tired

rate structure - Increases the cigarette tax to $2.25 per pack

- Increases taxes on alcohol and e-cigarettes

- Increases soft drink taxes on fluids, syrup anddry mixture

WV is the first state in the nation to implement this innovative program that will truly help build up our blue-collar workforce.

House of Delegates Version

H.B. 3300 – Relating to Personal Income Tax (PIT)

This bill is much different from the Governor’s PIT bill, S.B. 600.

HB 3300 was originated in the House Finance Committee and the bill passed on straight party lines 77 to 23.

This bill is a much shorter version (11 pages) than the Governor’s 75-page version. This bill does not increase any taxes, and it slowly reduces PIT based on gross income over a 10-12-year period. This bill creates an Income Tax Reduction (ITR) Fund to accelerate its pursuit of a full personal income tax elimination. The ITR will also serve as an additional reserve of funds to safeguard against downturns in the economy. Revenues will build up in the ITR through various means/sources.

Delegate Jordan Bridges (R-Logan, 24) giving a thumbs up after taking a test drive in the 2019 Ford Shelby F-150.

Senate’s Version

The Senate has amended and passed H.B. 3300. The House would have to concur with the Senate’s amendment; however, the Governor has already stated that he will not accept this version of the bill.

The Senate’s amendment has a number of revenue generating measures: (Total tax increases: $932,050,000) ($1,047,000,000 estimated shortfall)

- Increase in consumer sales tax from 6% to 8.5%

- Removes certain exemptions from sales and service tax

- Implements a 3% tax on certain professional services

- Increases a tax on tobacco and tobacco products

- Adds a hotel occupancy fee and tax

- Reinstates a food tax at 2.5%

- Creates 8.5% sales tax for prepared foods

- Modifies the soft drink tax

- Creates a dedicated lottery scratch-off game

- Legalizes recreational cannabis that would be subject to the sales and use tax

◦ Cannabis would also be subject to a special excise tax of 10% per ounce of the wholesale price

Lastly, I want to remind everyone of our upcoming Dealer Family Convention, June 13-16 this year at the Greenbrier. We are all excited and looking forward to getting together this year. We have a great agenda planned and encourage each of you to attend. You can find more information on our website, or feel free to contact me. Hope to see you soon!